As businesses navigate shaky economic conditions, finance and operations teams often find themselves at the helm, steering through a storm of challenges – from interest rate hikes and supply chain disruptions to surging energy costs and stubborn inflation. Amidst these headwinds, CFOs and their teams must chart a course that ensures a steady cash flow while bolstering profitability. A key step towards success? Automating the order-to-cash (O2C) cycle.

The backbone of financial efficiency, the order-to-cash cycle encompasses the vital steps from closing a sale to invoicing, payment collection, and revenue reconciliation. However, many finance and operations teams face challenges with broken and inefficient O2C processes that hurt productivity, reduce customer satisfaction, and result in revenue leakages. Recognizing and resolving these issues can profoundly influence revenue and strengthen the financial well-being of your organization. According to CFO Research, 57% of CFOs believe that resolving O2C pain points can reduce costs by at least 5% and drive a 5% increase in revenue.

In other words, there’s an untapped potential in transforming your O2C cycle, and many CFOs and finance teams are accessing it by leveraging automation platforms to eliminate manual tasks and accelerate cash flow. Gartner reports that 80% of CFOs are focusing on digital transformation efforts targeting financial processes, such as O2C automation.

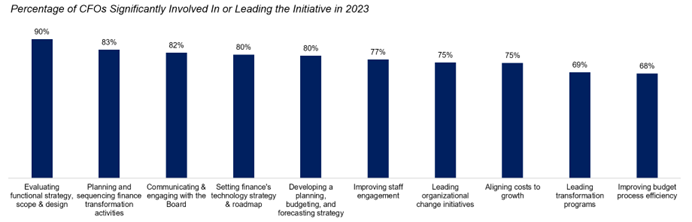

Among the foremost concerns for CFOs in 2023, integrating new technologies stands out as a crucial pathway to enhancing profitability during periods of volatility. Image courtesy Gartner.

Why finance and operations teams should automate the order-to-cash cycle

Finance and operations teams are often bogged down by manual O2C processes, spending an average of 10 hours per week on menial tasks such as creating sales orders, sending invoices, and reconciling revenue. Any hiccups that occur during these processes, such as manual errors, inaccurate data, and slow processing times, have a direct impact on revenue. Nearly half of all companies suffer from revenue leakages, and inefficient O2C processes can often be the culprit.

By leveraging the power of automation, finance professionals can transform their once-disjointed O2C cycle into a speedy and frictionless process. Automating key tasks such as invoicing, collections, and payment reconciliation let finance teams expedite payment collections and accelerate cash flow, ensuring a steady stream of working capital to weather economic uncertainties.

Tray.ai introduces O2C automation templates to free up finance teams and speed up cash flow

For finance teams, embracing automation is no longer a luxury but a necessity. Tray.ai's new Order-to-Cash solution emerges as a game-changer, revolutionizing how finance and operations teams approach the O2C process. With unprecedented flexibility, lightning speed, and full control provided by our AI-augmented low-code platform, finance teams can now transcend the confines of traditional manual workflows and unlock the door to powerful business outcomes.

With four new O2C automation templates that align with specific stages of the O2C cycle, our new solution delivers unparalleled efficiency to finance teams, freeing them from the drudgery of repetitive, error-prone tasks that once held them back. Developed in collaboration with Concurrent Services, a leading expert in NetSuite and Salesforce integrations, these new templates are designed for easy implementation that significantly impact cash flow right out of the box. Let’s take a closer look at each template’s capabilities and how they can transform your O2C cycle:

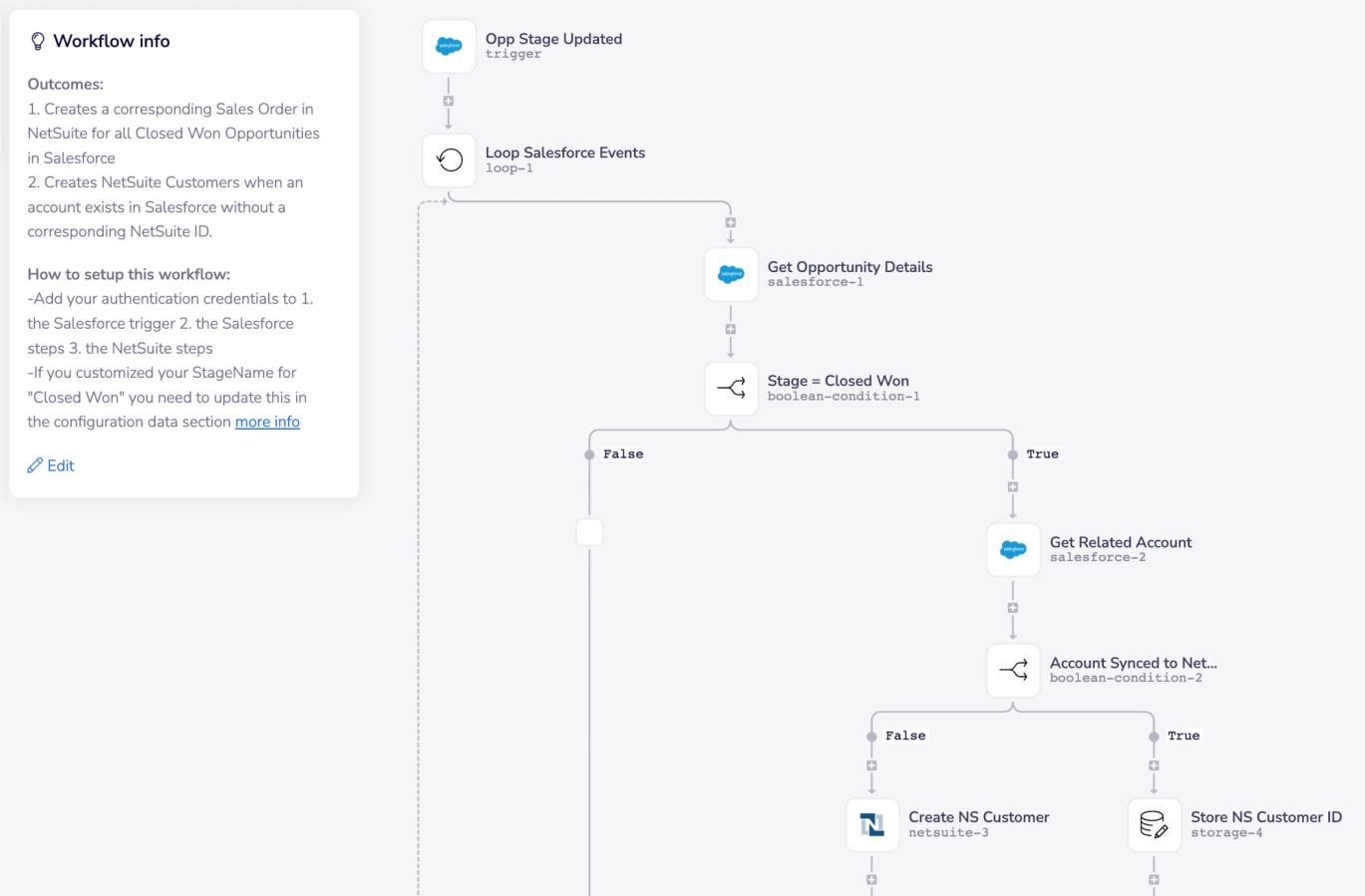

Salesforce Opportunity Closed Won to NetSuite Sales Order

The Salesforce Opportunity Closed Won to NetSuite Sales Order template bridges the gap between Salesforce opportunities marked as "Closed Won" and the quick creation of corresponding sales orders in NetSuite. By eliminating manual handoffs and paperwork delays, this automation accelerates the order processing time, reducing bottlenecks and speeding up cash flow. With real-time order creation, your finance teams gain unparalleled visibility into sales, enabling them to make data-driven decisions that foster business growth.

This workflow creates a sales order in NetSuite each time an Opportunity is marked as "Closed Won".

Salesforce Account to NetSuite Customer

The Salesforce Account to NetSuite Customer template takes customer-centric approaches to new heights. By creating NetSuite customers based on Salesforce accounts, this integration ensures seamless management of accounts across platforms, effectively eliminating data discrepancies and manual updates. This template enhances data integrity, letting your teams deliver consistent and personalized experiences that win customer loyalty.

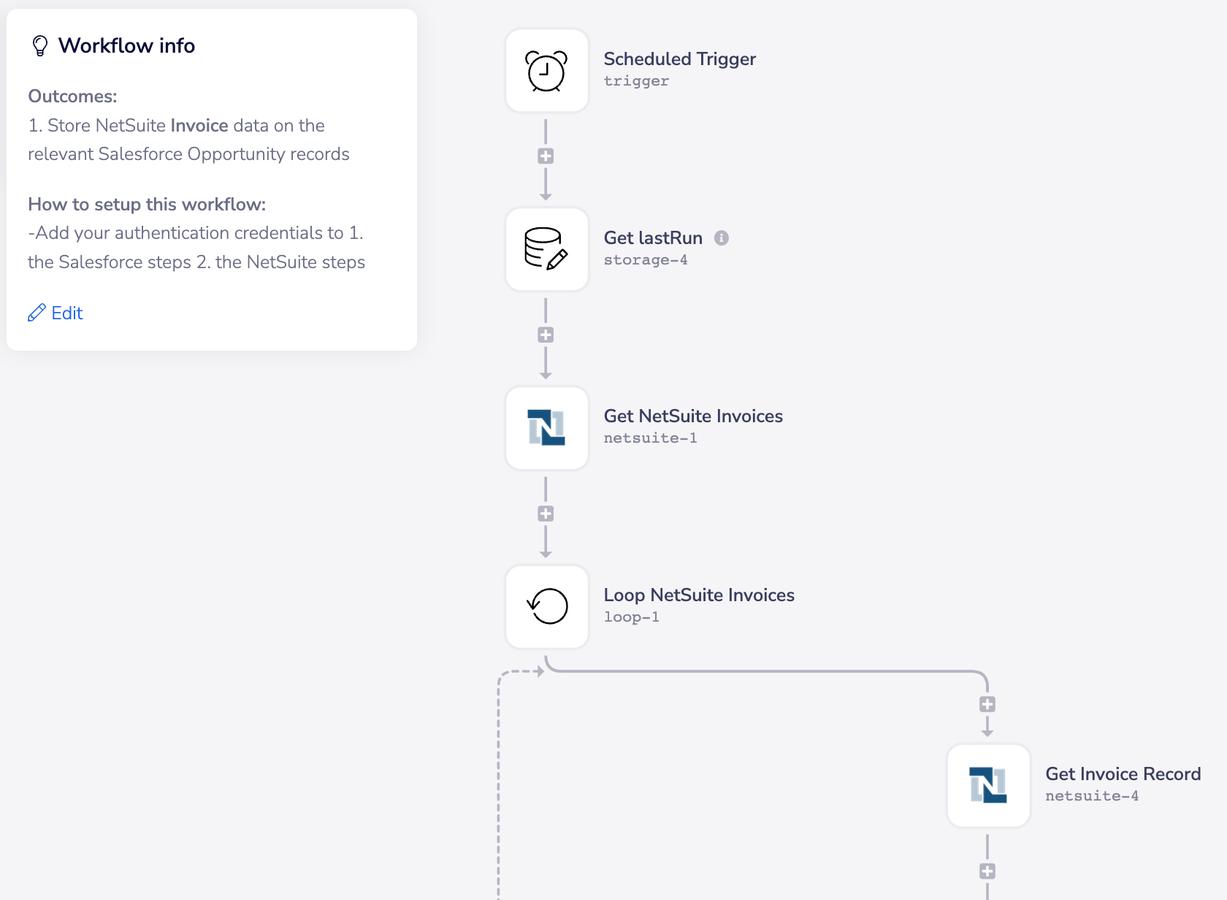

NetSuite Invoice to Salesforce Invoice

Ensuring accurate and real-time visibility into your O2C process, the NetSuite Invoice to Salesforce Invoice template synchronizes invoice information between the two systems. Armed with up-to-date invoice data, your finance teams can fine-tune financial management and provide exceptional customer support. From addressing payment inquiries to managing outstanding invoices, this template puts your teams in control, fostering smooth and reliable transactions.

This workflow automatically retrieves all the invoices created since the last time it ran and stores the NetSuite invoice data on the relevant Salesforce opportunity records.

NetSuite Payment to Salesforce Payment

In the fast-paced world of finance, timely payment updates are non-negotiable. The NetSuite Payment to Salesforce Payment template automates payment information updates between NetSuite and Salesforce. With real-time insights into payment statuses, your finance teams can optimize cash management and make smarter, data-driven decisions. Empowered with this information, your teams can seize new growth opportunities and navigate uncertain economic conditions with confidence.

Tray.ai’s Order-to-Cash solution in action

Mixpanel

Mixpanel, a global leader in product analytics software, leveraged the Tray platform to transform its O2C process, resulting in a 25% reduction in manual labor required to complete sales orders. By giving Mixpanel's finance team the tools to build necessary integrations and automations independently, Tray fundamentally changed its approach to automating processes, unlocking newfound efficiency and productivity.

Udemy

Udemy, a renowned online learning and teaching platform, harnessed the power of the Tray platform to integrate and automate critical aspects of its payment process. The outcome? An impressive ongoing time savings of 20-25 hours per month, previously spent on cumbersome manual work and data entry. The flexibility and scalability of Tray empowered Udemy to explore new automations across its tech stack, enabling the enterprise to offer self-service sales as a fully automated process—from customer order to payment.

Why finance and operations teams choose Tray.ai for O2C automation

Unlike other low-code and iPaaS products in the market, Tray.ai stands out with our cloud-first approach, offering organizations the ability to drive automation and integration at scale. Our commitment to expanding ERP connectivity within the NetSuite ecosystem lets finance teams build and maintain workflows with ease, transforming their O2C processes.

Our enhanced error-handling capabilities allow for quick identification and resolution of any issues that may arise, ensuring smooth and error-free operations. With user-friendly templates designed to accelerate O2C automation, finance professionals can significantly reduce manual work, expedite payment collections, and deliver exceptional customer experiences that set their businesses apart from the competition. Embrace the future of order-to-cash automation with Tray.ai today and unlock the full potential of your O2C cycle.