An uncertain economic climate has finance and operations teams scrutinizing every dollar coming in and going out. As businesses navigate these choppy waters, a steady cash flow is key to staying afloat. And nothing has a more significant impact on your cash flow than the order-to-cash (O2C) process.

Optimizing your O2C process through order-to-cash automation can lead to a 10 - 15% increase in total revenue. O2C plays a vital role in enhancing customer satisfaction, driving revenue growth, and maintaining a healthy cash flow. Yet, for many businesses, it remains a glaring blind spot. They grapple with outdated, manual, and error-prone O2C processes that eat away at profit margins, dampen customer experiences, and drag down operational efficiency.

To stay competitive and safeguard against economic headwinds, businesses need to take a holistic approach to their O2C process. With the power of low-code automation, finance and operations teams can transform their O2C cycle by seamlessly connecting critical revenue systems and automating key tasks that improve customer experiences and maximize revenue potential. Let’s take a closer look.

Understanding the order-to-cash (O2C) process

The O2C process is the mainsail of your business, covering the end-to-end sales journey from the moment an order is placed to the point where payment is received and applied to accounts receivable. This process is often complex and involves a number of different departments such as sales, finance and accounting, and even customer success teams.

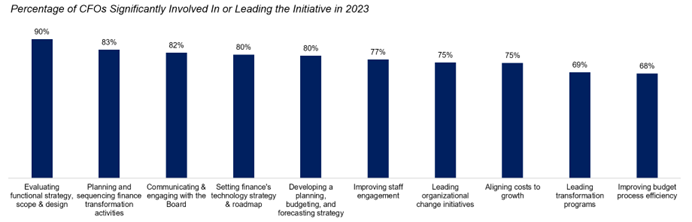

The overall health of your O2C cycle has a tremendous impact on customer satisfaction, revenue generation, and cash flow management, which is why so many CFOs and finance teams are laser-focused on optimizing their O2C cycle right now. In fact, Gartner reports that 80% of CFOs are focusing on digital transformation efforts targeting financial processes, such as O2C automation.

Of the top priorities for CFOs in 2023, incorporating new technologies is a key route to improving profitability in volatile times. Image courtesy of Gartner.

Automating the key steps of your order-to-cash process frees up finance teams to focus on more strategic initiatives such as data analysis and forecasting, improving cash flow management strategies, and identifying growth opportunities.

Typically, your order-to-cash process involves the following steps:

- Closed opportunity: The sales team closes a deal with a customer in the CRM system.

- Create sales order: Accurately capturing and processing customer orders, including creating a sales order in your ERP, such as NetSuite or Oracle.

- Order fulfillment: Delivering the items of the order

- Invoice order: Generating invoices and sending them to customers.

- Collections: Managing any overdue or outstanding payments from customers.

- Apply payment: Collecting payments from customers and reconciling them with accounts receivable.

- Reconcile orders: Ensuring that all orders are accurately recorded and invoiced.

- Reconcile revenue: Verifying recorded revenue aligns with actual earnings

However, many organizations have a fragmented order-to-cash cycle, relying on a combination of manual tasks, point solutions, and out-of-the-box integrations. This jury-rigged approach leads to revenue leakages and inefficiencies throughout the O2C process due to manual errors, limited connectivity, and inflexible integrations. Let’s looks at the common problems finance teams face with their O2C process.

Challenges of inefficient O2C processes

Manual tasks eat up resources: Manual processes such as creating sales orders, sending invoices, and reconciling revenue consume an inordinate amount of time for finance teams, gumming up the order-to-cash process with delays and errors. This is time the finance team could have devoted to strategic planning to grow the business but is instead spent on menial tasks.

Lackluster out-of-the-box integrations: Poor connections between your CRM, ERP, and billing systems create silos, fragmenting your O2C process. Inflexible out-of-the-box integrations only lead to extensive engineering efforts to build and maintain custom workarounds.

Loss of revenue due to lengthy approval processes: Lengthy approval processes for contracts and sales orders only frustrate B2B buyers who expect a fast and efficient experience, leading to lost deals, extended sales cycles, and missed upsell opportunities.

Non-compliance with regulations: Complex and manual O2C processes make it difficult to adhere to security protocols and compliance regulations, especially when dealing with sensitive customer and payment data.

The benefits of O2C automation

Improved connectivity: With customer and payment data spread across different applications in your revenue stack, connectivity is critical for flowing order and payment information through the O2C cycle with minimal friction. By connecting CRM, ERP, and billing systems such as Salesforce, NetSuite, Quickbooks, and Stripe for a smooth, bi-directional flow of data, finance teams can eliminate data silos and manual errors.

Cash flow management: An efficient O2C process has a significant impact on cash flow. By automating O2C tasks such as invoicing, collections, and payment reconciliation, finance teams can accelerate payment cycles, improve cash flow predictability, and plug revenue leakages.

Customer satisfaction: 77% of B2B buyers claim their last purchase was overly complex. Today’s buyers expect speed and efficiency when it comes to making purchases. By reducing manual work, automating approval and contract management processes, and streamlining order fulfillment and invoicing, finance teams can deliver a quick and accurate purchasing experience, enhancing customer satisfaction and loyalty.

Today’s B2B buyer expects a B2C-like purchasing experience. Low-code automation lets finance teams deliver a quick and personalized buying journey. Image courtesy of Gartner.

How to end manual work with O2C automation

Low-code automation platforms give finance teams the power to seamlessly integrate their entire revenue stack, automate critical O2C processes, and expand their O2C scope to include renewals and upsells for maximum revenue potential. Here’s how:

Seamless integration of the revenue stack: With 600+ connectors available out of the box plus the ability to build your own via a low-code builder, finance and operations teams can quickly and seamlessly connect their entire revenue stack to their precise specifications. No need to rely on manual workarounds or ongoing maintenance.

Automated approval and contract management processes: Finance and operations teams can deliver a first-class sales experience by automating the approval process for contracts and sales discounts, and routing opportunities to relevant stakeholders for approval via email, Slack, or any preferred messaging system. Once approved, contracts are automatically generated and sent using e-signature solutions such as DocuSign, expediting the sales process and elevating the customer experience.

Expanding the O2C scope to include renewals and upselling: Today’s shaky economic landscape is pushing organizations to think beyond traditional O2C automation by incorporating renewals and upselling into the process. With a modern O2C automation solution, finance and operations teams can automate onboarding, send personalized notifications and reminders for upcoming renewals or negotiations, and provide insights into product usage and support tickets, letting businesses increase customer retention, cross-sell, and upsell more effectively.

Why finance teams choose Tray for O2C automation

Times are changing. Organizations are rapidly recognizing that the order-to-cash process extends far beyond its traditional boundaries. Modern businesses must strive for end-to-end automation across the entire buyer’s journey, from lead acquisition to renewals. Achieving this comprehensive automation is only possible with a robust and flexible automation platform like Tray, which allows teams to go beyond the conventional order-to-cash process.

Here’s what finance teams can expect from Tray's O2C automation solution:

Plug-and-play standardized templates: Tray provides finance teams with standardized O2C templates, offering an easy-to-use starting point that can be customized and configured to your specific needs and ensuring a quick and seamless implementation. Check out our templates to transform O2C processes:

- 'Salesforce Account to NetSuite Customer': Create/update NetSuite customers every time a Salesforce account is created/updated.

- 'NetSuite Invoice to Salesforce Invoice': Sync NetSuite invoice information back to the originating Salesforce opportunity daily.

- 'NetSuite Payment to Salesforce Payment': Align NetSuite payment information with the corresponding Salesforce opportunity daily.

Purpose-built and maintenance-free connectors: Finance teams need reliable, up-to-date connectors for seamless integration with their critical business systems, such as NetSuite, Salesforce, Xero, Quickbooks, and more. Connectors are always up-to-date to ensure compatibility and frictionless data flow.

Expert services and partner engagements: No matter the complexity of your integration project, finance teams have access to Tray’s top-tier support, a network of partners, and a community of subject matter experts.

Unlock the full potential of your order-to-cash process

The order-to-cash process is the backbone of your business operations, directly impacting revenue generation, customer satisfaction, and overall financial performance. Today’s organizations cannot afford to rely on outdated, manual, and disjointed O2C processes that hamper efficiency and hinder growth.

It's time to unlock the full potential of your order-to-cash process with Tray's low-code automation platform. Embrace the future of O2C automation today, and see the transformative impact it can have on your business growth, efficiency, and profitability.

Check out our complete guide to order-to-cash automation to learn more.