- Build

- Code

- Chat

- Process automation

- Data integration

- API management

- Agile connectivity

- Integration marketplaces

- Merlin Intelligence

- Merlin Agent Builder

- Enterprise Core

- Plans

- Connectors

- Information technology

- Revenue operations

- Product and engineering

- Finance

- IT Onboarding

- Lead lifecycle

- Embedded integrations

- Order-to-cash

- E-commerce

- Salesforce

- Slack

- NetSuite

- Snowflake

- JIRA

- Zendesk

- Hubspot

- OpenAI

- Customer stories

- Events and webinars

- Blog

- Tray Academy

- Community

- Tray Advantage

- Documentation

- Find an expert

- Templates

- Developer portal

- Company

- Get in touch

Order-to-cash automation and the Udemy transformation

See how Udemy connected CRM and ERP systems to accelerate cash flow, improve revenue visibility, and scale operations efficiently.

Overview

Faced with growing complexity in its customer and billing systems, Udemy needed a better way to manage order-to-cash (OTC) workflows. Manual work slowed collections, limited cash flow visibility, and increased operational risk. Learn how Udemy integrated its CRM and ERP systems with Tray to automate OTC processes, accelerate revenue recognition, and deliver a better customer experience.

What you’ll learn

How Udemy shortened the OTC cycle and improved collections

Why CRM-ERP integration was critical for cash flow visibility

How automation improved customer satisfaction and reduced churn risk

Lessons for building scalable, flexible OTC workflows

Session chapters

Introduction: Udemy's order-to-cash challenges

Why modernization was critical for Udemy

How Tray connected CRM and ERP systems

Improving automation and accelerating cash flow

Business outcomes: customer impact and growth

Q&A session

Featuring

Paul Turner

Automation Expert

Jing Chen

Enterprise and Business Applications Director

Transcript

Today, we have a great topic.

We're going to talk about order to cash automation, how it fits into this landscape, dive into a real world example, how a company Udemy has implemented it, going to the challenges as well as the tangible benefits that they are seeing. We have two great panelists today with us, so let's jump into the introduction.

Jing, why don't you introduce yourself?

Yeah. Sure.

Oh, hi. I'm Jing. I'm from Udemy.

So Udemy is a education tech company, and our vision is to improve lives through learning.

I'm responsible at Udemy, I'm responsible for our internal business application development. That's CRM, ERP, people system, as well as the enterprise level integration automation.

So actually our team's vision is to transform business vision into reality through technology.

So iPaaS solution, you know, at Tray, has really been an important part of our tech stack and helping us executing our vision.

Thank you, Jing. We have Paul from Tray.

Oh, thanks, Anne. Thanks, Jing. Yeah. So over here at Tray, so at Tray, we really provide low code automation, so enabling really companies like Udemy to connect, integrate, and automate their stack and improve their processes.

My background, I started my career implementing Finite Systems, and then spent a long stint at NetSuite launching their revenue recognition, auto cash integration, and, I spent a lot of time in revenue planning and forecasting as well. So working with Salesforce, revenue analytics, as well as, companies like SAP Catalyst Cloud, for things like sales quarter and territory optimization and those kinds of things. And I also I check I run the largest RevOps group on LinkedIn as well. We're at about thirty three thousand members, I think. So, you get lots of good feedback from everyone from finance and sales ops and everything in between.

Thanks, Paul. So perhaps to get started, let's kind of, you know, set the table stake. Not everybody is very familiar with, you know, order to cash.

Can you, Paul, kind of define what it is and the traditional definition for our audience?

Yeah. The well, I mean, I think Jing’s really gonna dive into it, it's changed dramatically over the last few years, and it does differ quite a lot, I'd say, depending on the organization as well as the industry you're in, as well, right, whether you're in B2B or B2C, for example.

But, you know, but generally, and, you know, we're gonna bring that delve right into how does this change a little bit later than this. Right? But it's really really showing the sales quote that your sales team, right, is presenting really matters nicely up to your price book. Right?

Wherever that is, your ERP. So really, they're presenting an accurate quote.

You have all the approvals in place, you know, from your deal from your deal desk. Right? So you know, your sales team isn't presenting a quote that is not gonna get approved. Right?

So really, accuracy, really showing a, you know, a nice experience from the prospect perspective, right, at the point they're gonna become, a customer.

And then you really kinda flows into the finance side of things, right, ensuring that, you know, whatever CRM you're running, you know, obviously, it's typically it's Salesforce, probably you've got that closed opportunity that it flows into the ERP system. So whether you're running NetSuite or maybe you're running Dynamics or SAP, any ERP that flows in. And all of the details carry across correctly.

The address information, the order lines, it all flows in.

And then really, it's once again, in the front side of the house, it's getting the invoices out, getting the invoices out accurately. Right? So you wanna really minimize some of that rekeying around that. Right? Nothing hurts a customer relationship initially than sending out invoices incorrect, right, or spelling mistakes, or doesn't match up to what they signed.

And then really it's in the cash application side of things as well, right, so when the customer pays, right, understand it when it's in your bank account and then applying that to your books and minimizing the amount of time you're taking on that thing around. And then obviously revenue recognition, whole different webinar, right, or ten webinars on revenue recognition, everyone's favorite topic.

And then obviously the reporting around that. So really it's that smooth flow, right, everything from the quote all the way into finance, all the way through to receivables and reporting on the other side.

And, yeah. So I would say that's the classical definition.

Thank you. And so Jing, you know, clearly in today's modern business, this has evolved. Can you give us a perspective at Udemy and in general how this has evolved?

Oh, sure. I would like to focus maybe more on the automation part and then the integration part. Right? So, traditionally, when we talk about the O2C automation integration, usually, it's one way.

Right? So, you know, as Paul mentioned, you integrate CRM with your ERP, specifically, the Salesforce information. Right? From your Salesforce to your NetSuite to whatever ERP system you're using.

Once that's done, your integration is complete. Right? So at Udemy, we actually extended the approach to close the cycle by integrate ERP information, the customer payments, invoices, balances, everything back into CRM into the CRM, which is Salesforce we have here, to provide a 360 view of the O2C process.

Thank you. And so with, you know, can you walk us through your initial approach when you started working with Tray and how it's evolved over time?

For sure. Yeah. As mentioned. Alright. So, you know, when we first started, right, the O2C automation is more, I would say, you know, tactical.

When I first joined Udemy, basically, we were in this hyper-growth period.

So our B2B business, they were growing at a rate of, I wanna say, seventy percent year over year.

So we needed a solution, a scalable solution, right, to be able to shorten the order to cash cycle.

So we use Tray, really, to integrate the sales order between CRM Salesforce and our financial system, NetSuite. Right? So at that time, the objectives, you know, is quite straightforward. It's just efficiency and accuracy.

And then so slowly, we actually you know, once that's processed working really well, we actually extended the approach or rather evolved to be more strategic, as you mentioned. Right? So we use Tray to bring back the cash information, you know, like customer invoice, payments, and then balances, you know, back to Salesforce, from NetSuite.

Thank you. Can you elaborate a little bit on one of the benefits being the visibility of your sales and customer service teams and how this has been impacted, you know, particularly in cases of payment issues?

Yeah.

I wanna say we've seen probably two, at least two, very positive outcomes, from this integration.

Right? So with this visibility, we actually enable our sales work and our CS work to help with the collections.

Right? What you know, when I mentioned we have, you know, seventy percent year over year growth, And then definitely, organically, we'll have a little bit more, let's say, delinquent customers as well. So rather than, you know, hiring, you know, a bunch of people in collections, you know, with visibility, we don't have to do that and then sales can help that. So that really helps with our revenue in the cash collections. That's one.

Secondly, so for our, CS and then the sales to be able to identify maybe potential churn risks, Right? And then enable the CS team to focus on more strategic accounts or, you know, quote unquote, like, good customers.

Thank you.

To that and, you know, question for either of you. How do you see the broader business landscape shifting towards that more comprehensive revenue visibility?

I don't know, Paul, if you wanna take that one.

Yeah.

So I think what's, at least when I look at the, the group, the LinkedIn group we're running, it's mostly early stage companies now, are restarting from an integrated RevOps perspective.

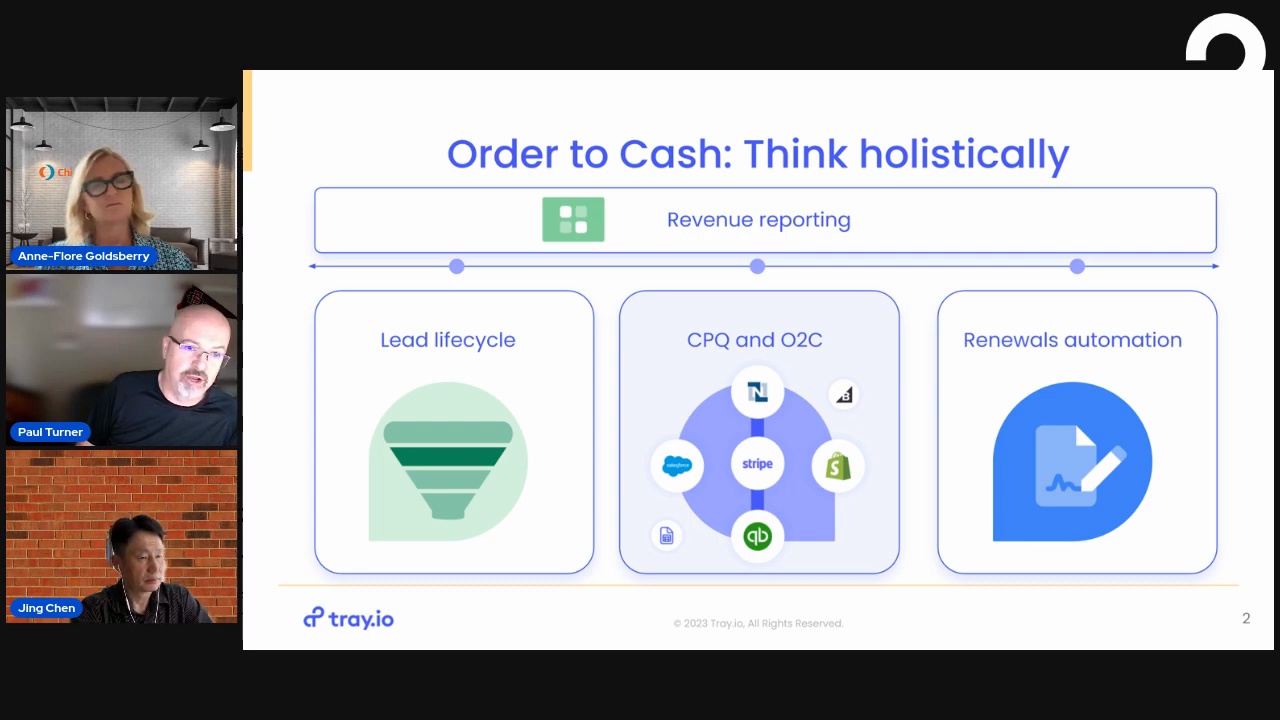

Right? So they're looking really aligning everything from their lead life cycle, right, to their CPQ, LPC processes, renewals, and revenue reporting around that.

I think there's a couple of drivers around this. Right? You know, as Jing kinda mentioned, that, you know, companies are really focused on renewals now. Right?

That's become that that's hitting a lot bigger, and larger. Right? I think companies are looking to maximize revenue from their existing customers as well. Right?

So you gotta take an integrated perspective on there and really, really providing your CS team, you know, with visibility. So it's not just on the front end. Right? It's on to a customer.

So, again, the second area is really revenue reporting as well. Right? Really, again, that integrated revenue perspective early from, you know, subscriptions and billings and renewals and upsells. Brian taking that, getting that holistic view and, yeah, up until you know, typically, you know, it's been pretty fragmented.

Right? You know, the renewals team have one picture. Right? You know, finance another picture.

SalesOps has some other reports as well. And especially with the advent of things like Snowflake, for example, where you can push it into a single repository, right, it's starting to move much more towards a kind of integrated revenue view. That's really important, right, when cash is king in this kind of environment.

When I look at it, it's really from a process perspective, marketing is a bigger part within the up funnel, right, in the lead to cash process. So even things like marketing and managing marketing programs based on their anticipated revenue conversion, right, you know, here's your revenues. And the thing is to generate, you know, what's he budget, you know, around that to drive that, ensuring the leads are routed quickly, right, to make sure that they convert, right, all the way through to receivables as well. Even things like aligning sales conversation right around receivables too and those areas as well. So it's taking a much, it's a much more integrated process across all different channels of the company.

Thank you. Jing, do you have anything else to add to that?

Yeah. No. I totally agree. It was everything positive. Right? So it really definitely enables, you know, business to be more strategic. And then with the data, so, you know, you know, from, you know, really from the financial system, from its CRM, we're actually able to build out, you know, a lot of dashboards.

You know, with the let's say, with the information from the ERP side. However, with the structure, let's say, the team structure, the sales structure on the CRM side, you know, be able to provide really better visibility, better dashboards, So for the business to make decisions.

Thank you. One area I'd love to get your take, Jing, is, around upselling.

I mean, clearly, upselling. We've talked about the visibility, the revenue, but upselling is clearly a critical area. How does Udemy leverage this and what benefits have you seen?

Yeah. Sure.

We actually yeah. We have used iPaaS, in this case, Tray, to create leads and then generating upsell opportunities in our CRM Salesforce.

So we do have a self-serve product where a customer can buy a small number of licenses with credit cards, and then we use Tray to bring in those sales information, into our Salesforce, as leads for upsell.

So this kind of solution or decision rather, you know, it's kind of easy to make. That's I think where the iPaaS like, you know, Tray excels. It's the agility. Right? You know, Tray has pre-built connectors with our payment processor.

So this is really no no-brainer. A lot easier to implement this than we had to build something ourselves.

Thank you.

And I think I think just one key thing to follow on that is that what one of the, kind of traps I see companies fall into, is you go going back to that slide, there is the companies start out thinking they just need to solve, you know, that classical definition, right, of order to cash. You know, just get the sync in place right between the CRM and the RP. You know, make sure that that, you know, minimize on the rekeying from the account team. Right?

Maybe get some of the quotes lined up. But, ultimately, that's really probably only about, you know, ten percent of the process, right, you wanna get to. Right? When you zoom out and look at that RevOps view, you know, of integrating the lead process of, you know, read, equipping your service desk to have visibility into receivables, right, to drive upsell and renewals, right, from their ticket system, you know, Salesforce, through to getting that that single point of view from a revenue perspective, right, to flow and data in across all those different applications, whether you have Markelo and NetSuite, right, and, you know, Zendesk and Salesforce, flowing that in for that revenue reporting perspective.

And what are you typically what I've seen a lot is, you know, companies solve for a system just to handle O2C. Right? And then they have to start from a blank sheet of paper with a whole different set of automation tools and apps to handle these other areas or it's manual. Right? And so yeah, you've gotta kinda you gotta architect for growth. Right? You gotta architect to grow towards this rather than just hitting a, you know, hitting a wall if you wanna make one process and that's it.

Well, exactly to that point, Paul. I'd like to elaborate a little bit on that because it's this notion of customization.

Every business O2C process is different.

And so what challenges does this cause for the businesses, you know, embarking on O2C automation projects?

Yeah. Yeah. I mean, coming from the world of ERP, no ERPs look alike on paper. Right? And, but at this point, a company's ERP, it's very different from someone else that we may run-in the same ERP.

You have custom fields.

You know, whether it's in Salesforce as well or in NetSuite or, you know, Dynamics. So you'll have a heavy amount of customization, and that means that even that alone means that everyone's, you know, O2C process is a little different, right, in terms of the information you're seeking, between the two applications.

Even things like, for example, approval processes. Right? Who's approving, you know, and the rules, around that. You know, those processes are different as an organization changes as well.

Right? And you wanna apply different different approval rules around that. And then even if you move into things like, you know, acquisitions and multi-country and multi-currency. Right?

That's a whole different kind of can of worms as well. Right? In terms of how everyone is that process different.

So when you look at it, and also different companies have different lines of business as well. Right? You know, you might have a, you know, some of your subscriptions and I think that only another company might have a heavy service business as well. Right? And so, even that alone can make a big difference as well. So everything from straight customization to different lines of business, right, to organizational change, to geo change as well.

I would say that the chances of, I don't know. Jing can probably correct me on this, but the chances of every someone's O2C process being exactly alike, between one company and another, I would say it's near zero. Let's just say it's near zero.

Okay.

Thanks. To that point, Jing, so how do you balance the customization and, making sure you have a process that's robust and efficient?

Absolutely. No. That's a great question.

So I think we have to decide when we streamline we won't decide you know, we everyone wants to streamline their O2C process. When we do that, we had to make a decision first. Whether we wanna buy or wanna build ourselves.

Right? So for us, it was pretty easy. We wanna really buy, you know, really, the iPaaS solution because we're not in a business building iPaaS solutions. Right?

So which enables us to be able to focus on the business problem, business problems and then solve them in a timely manner. Right? As I mentioned, you know, we chose Tray because of agility, right? Because of the pre connectors we already built.

So that makes it a lot easier for us to make the O2C process a lot more efficient. Right? And then when we start building that, like say, building, you know, on top of Tray, our principle, I have to say, just keep it simple and stupid. Right?

So like the key principle.

I would say try not to develop, you know, too much transformation inside of integration. Right? Don't turn integration into a black box.

For instance, if you need to, you know, map something or need a mapping between Salesforce or NetSuite, you know, you try to do it outside integration if possible. You can create a form, for example, inside of Salesforce or stability inside the NetSuite, avoid any hard coding in your integration. So in the future, if there's a change or, you know, there's a new value set, it becomes more configuration rather than the development. Right? In that case, you don't need to even touch the integration you build. Just make it simple.

I think that's a really good observation.

I think one of the mistakes I've seen with multicash projects is that they heavily rely on outside consultants and the vendor to build the process and to build the integration.

And often it can sometimes come up. There's a couple of kinds of pitfalls around that. You know, the first is rigid. Right?

You know, someone else has built it for you and implemented it for you. Right? And guess what? Right?

When you wanna change that approval. Right?

Or you, or you may or you gotta add an additional, you change your pricing, for example. Right?

Or you add a new custom field, right, to NetSuite. You've gotta call them back in, right, and, and and and make that change. And I think a lot of folks, especially on the finance and, you know, the apps, the things are typically pretty used to relying on a vendor, right, to come in and do the implementation. And in my view, that might work with, you know, typical kinda core ERP processes, but because the O2C process kinda transcends multiple systems, there's much more of an animal of the organization, right, an organizational change.

It's really important that the company itself is in control of that. Right? You are in the driver's seat to make changes and you're not reliant on someone else to make those changes for you. And I think that's one of those the key one of the key successes with them with Jing and Udemy is that they're really in charge of the, really in charge of the process. Right?

And that ensures that no one's shortcutting it as well. Right? There's no, the manual workarounds don't start to creep back in, right, because the business rules and the automation are staying current with the current with the business.

Correct. And one thing, what should be given, Paul? Could I mean, I'm sure it's common sense, but can you elaborate a little why it's so important that the process transcends the current tech stack?

Yeah. Yeah. I mean, I mean, it's like, you know, I started my IT career in the mid nineties.

Right? And let's face it. Right? The stack you're running wasn't gonna change very much. Right?

You know, the ERP, and it was and everything was a little simpler. Right? There was, you know, the finance was running pretty much an ERP, and that was pretty much it. Right? ERP spreadsheets.

And what you see over the last well, guess what? Especially with the advent of cloud, right, is that stack changes really are really a given, right, at this point. And a couple of examples, right, you might be migrating to a cloud. I mean, if you're a larger company, you might have an on premise ERP.

Right? And you might be migrating to a cloud, ERP, for example. Yeah. Maybe you're moving from say, you know, maybe you're moving from SAP R3 to S4HANA.

Right? Or maybe you're moving from QuickBooks to Nestle. Right? So, you know, ERP changes is kinda underway.

Also, acquisitions, right, and running multiple ERP instances as well. Right? That's a consideration. Right?

If you make an acquisition, it takes a long time to move to that single instance. Right? But you've got to make sure that your order management processes transcend that. Right? The customers aren't disrupted.

The customers don't have the arms seat behind the curtain that you're running more PRPs. Right?

And even things like on the reporting side of things as well. Right? You know, you have new companies that are deploying things like, you know, you have Snowflake or, you know, Redshift or, you know, BigQuery and those kinds of things for reporting.

And, how do you realign your revenue reporting with your new kind of analytics stack as well? How do you bring the data from across the different systems? And then, I mean, one thing we've seen at Tray, for example, is even the marketing automation side of things. Right? I know we've just talked about lead life cycle, and lead management is and when you look at RevOps, right? RevOps is ultimately marketing ops.

It's sales ops. Right, and it's customer service operations as well. But, you know, on the marketing ops side of things, there's a huge amount of stack change, right, within marketing alone.

And even companies moving from their marketing automation platforms, for example, we actually recently migrated from, you know, from Marketo, and we're now running our automation on our own platform, for example.

So the pace of stack change is much faster than it was, and the amount of complexity in a stack. I mean, you might have an application for revenue reporting for revenue revenue, for example. You might have another application for receivables. Right?

You've got, you know, Salesforce, Microsoft. So the amount of complexity of the stack as well. So it's really important that you have your stack, but your process, you know, transcends the stack. Right?

And then it gives your organization the freedom to make changes to the stack. Right? And it also puts you in the control of a single cockpit of process change as well where you can you have to come to god mode. You can look across the process, and you don't have to worry about the complexity that the system is beneath.

Thanks. So Paul, we have a few minutes. Look. For those who wanna get started, I believe you guys took that, you know, crawl, walk, run approach. Can you briefly talk about it, as well as how you, you know, you got the hands on approach? I believe there's a Tray Academy. Can you give some tips to our audience about how to get started?

Yeah. I think I kinda touched on this a little earlier on.

I think a really important part of this, and I think one of the things that, you know, Jing and the team have really done, pretty, you know, differently from the norm, right, of, you know, of, I'd say, old school or to cash is much more hands on.

Right?

Correct.

Yeah. So I think you'd really your local, like, you know, choice is very easy to be hands on. I might recommend that anyone's new to this, just start building something, something small, and then you can iterate it from there. As you mentioned, right, we use, like, the Tray Academy, heavily.

So really that's how a lot of folks learn Tray, using it at our organization.

Furthermore, I would like really encourage everyone to, you know, to sign up on, you know, like the Slack channel. So their Slack channel, basically, you can actually ask questions. You know, there will be, you know, other customers there. They may have a similar problem, or they may have very, you know, creative solutions. And I believe, you know, train architects there as well to help you. So definitely take advantage of that.

Yeah. And you can use the templates are a stop on an end. Right? You know, you know, you use the templates, so we provide auto cache integration, for example, between, you know, Salesforce and NetSuite, and you can use that so you're not starting with a clean canvas. Right?

Then go ahead and start customizing, right, to your process.

You can get that in place, and then you can start to look at other processes right now. Maybe you wanna sync your NetSuite, you know, price book to Salesforce for a quote, for example. Right? Or maybe you wanna start pushing some of the receivables data into Zendesk, for example, right, to give a status for your CS team. Right?

They're gonna start to learn something new to Snowflake, for example, for some reporting. Right? And so you can use the templates as a starting point, and then start to grow, from there versus taking a kind of a big bang approach. But the key is to, and, you know, Jing really touched on this, is to get hands on, because ultimately, you wanna own the process.

Right? You wanna be in control, and you're gonna be empowered to make the changes, yourself. Because that's really ultimately the way you improve the process as well. Right?

You know, if, for example, you're getting orders, god forbid, flowing into your ERP that don't fit your deal desk. Right? Well, guess what? You want the approval.

You want the ability to put approval in place. Right?

And you want the audit trail around those approvals as well. Right? So you can iterate that process.

So that control aspect and so that but that's why, for example, at Tray, that, you know, we provide a trial. Right? So you can sign up today, provide some for a trial and get hands on. You don't wanna get a whole vendor demo.

Right? You can start building. Right? You can start using the templates we provide, you know, right after this call.

You know, as Jing mentioned, the Slack channel where you can reconnect with other folks in the building like Jing, for example. Right? And then the Tray Academy, where you can start taking low code learning tracks as well. Right? Learn how to build your first automation, and all those kinds of things too. So we're back getting hands on.

Thank you so much. Well, Paul, Jing, thank you so much for sharing your insight. For those of you watching, I hope we were able to demystify order to cash. And feel free to send any question, and we'll be able to reply. Thanks, everyone. Have a great day.

Absolutely. Thank you. Bye.

Let's explore what's possible, together.

Contact usMore like this

Leveling up to low code: ShipStation’s journey to automating IT onboarding and offboarding

Learn how Auctane’s IT team automated onboarding and offboarding to drive growth, improve compliance, and reduce manual work using low-code automation.

Escape the legacy integration trap: Why IT needs to move to low-code platforms

Learn how modern low-code platforms help IT teams deliver faster, reduce technical debt, and simplify integration governance.

An in-depth look at Merlin AI

See how Tray’s Merlin AI helps teams build faster, smarter workflows—using natural language and a flexible architecture designed for enterprise scale.